Musa, a Bureau De Change (BDC) operator, bailed out his elder brother after operatives of the Economic and Financial Crimes Commission (EFCC) raided a popular BDC hub in Zone 4, Abuja. He says BDC’s are filling the foreign exchange demand of citizens which CBN has failed to process fast enough. During my conversation with Musa, he said his elder brother was whisked away. “EFCC said we are operating illegally but we have our licence. I don’t know what their problem is. CBN doesn’t give businesses fx exactly when the businesspeople need it. When the demand is very high, the dollar price will increase. We are the ones giving them. Our customers want to get their dollars immediately.” According to him, regular citizens and business owners would come to them for fx which they were able to get on the spot as against the unending wait after filling documentations such as Form A for invisible transactions (PTA/BTA, medicals, education and other remittances) and Form M (form to be filled for fx payment in visible trades) through deposit money banks.

It would be recalled that the naira fell to an all-time low of N800/$1 following CBNs announcement of the naira redesign, and a surge in dollar demand, thereby widening the parallel market margin when compared to the official rate. This led to EFCC’s arrest of some BDC operators and currency speculators in the parallel market. Following the arrests, Director of Operations at the Economic and Financial Crimes Commission, Abdulkarim Chukkol said the Commission considers foreign exchange malpractice as an economic crime against the Nigerian state.

WHY ARE MORE NIGERIANS TURNING TO BDC’s FOR FX

Speaking with a major manufacturer in Nigeria who declined to be mentioned, he said to me in a matter of fact tone “ I get 90% of my fx for business from the black market and the other 10% from CBN. For example, I fill form M requests of $1million and my company is allocated only $10,000. What do you want me to do with it? I need the business to keep running and as such, I go to the BDCs and get fx at black market rate”

I spoke with Chiweike who constantly receives diaspora remittances. I asked him what his most preferred channel of exchange was.“I received a total of $47,950 in 2022. I can’t change with the bank . I get better deals with my BDC operator. CBN cannot give us a window for a parallel market rate with such a wide margin from their official rate and expect me to go with a lower rate. They should have a single and stable exchange rate.”

Although the CBN allowed a slow depreciation of the official exchange rate, this was insufficient to bring the supply and demand of foreign currency which includes the dollar, Yuan among other major currencies into balance. The official rate depreciated by 5.2 percent in 2022 through November while the parallel market rate depreciated by 40%, with the parallel market rate premium widening from 37% in January to 71% in November.

HOW BDC’S BALLOONED OUT OF CONTROL AND CBN WATCHED

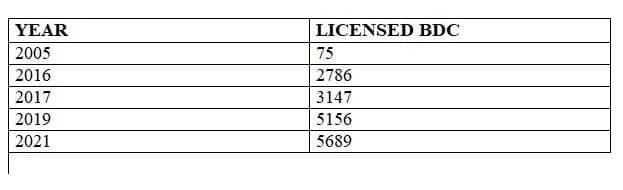

Originally, BDC’s were to serve retail end users who needed $5,000 or less. According to CBN, Bureaux de Change were licensed in 1989 to allow access to “small users of foreign exchange” and to deepen the officially recognized FX market of which exchange rates in the Bureaux de Change will be market driven. According to the Central Bank of Nigeria, scarcity in the official sector and prevailing bureaucratic procedures necessitated the growth and development of the parallel market. In 2005 there were just 75 BDC licensed by the CBN and this number continued to grow exponentially as parallel market margins widened. Fast forward to February 26, 2009, when CBN restructured BDCs into categories A and B in order to liberalize the FX market, enhance its allocative efficiency, and facilitate end-user access to foreign exchange supply. It was expected to promote efficiency of small and medium scale enterprises. This initiative was short-lived as it became a channel for rent seeking and racketeering. By November 8, 2010 CBN withdrew the license of all existing Class ’A’ BDCs. Apparently, the target end-users had been sidelined while large transactions that should have been channeled through the banking system were carried out through Class ‘A’ BDCs.

COULD THIS HAVE BEEN A PERFECT TIME TO REVOKE AND EXPUNGE THE LICENCES OF BDC’S?

Worthy of note is that prior to 27th of July 2021 when CBN commenced the refund for BDC licensing fees, Nigeria was the only country in the world where the Central Bank sold dollars directly to BDC’s. This move by the CBN only made the BDCs totally unaccountable, as they were no longer obliged to report transactional operations of total fx sales and to who they were sold to.

It may be argued that the BDC’s were aided by the CBN for so long even as they saw the threat it posed to the country’s economy. While BDC’s may not be the singular cause of the pressure on the naira, experts consider the multiple exchange rate regime allowed by the CBN, one of the major challenges keeping local and foreign investments at arms length from the country.

SHOULD THE CBN MAINTAIN ITS STANCE ON PARALLEL MARKET RATES OR A UNIFIED RATE AND HOW CAN WE GROW NIGERIA’S FRAGILE ECONOMY?

I engaged the Former DG of the Securities and Exchange Commission and Former treasurer of World Bank Arunma Oteh, on her thoughts regarding CBN’s FX provision strategies and multiple exchange rates in the country. “My take is that a unified exchange rate is more transparent, fairer and more equitable. It prevents corruption, and rent seeking. I suspect the objectives of the CBN include support to manufacturing and other productive sectors. Sadly, it is difficult to implement in Nigeria.” she said.

“Export! That is one solution. I do not depend on anybody to supply me foreign exchange needed to run my business anymore. To get FX to purchase the raw materials I need for my business, I produce goods and supply outside the country and then I’m paid in dollars. I recently supplied the Sierra Leonean Military cars and I was paid $4.7million which would be enough to buy raw materials I need for my business at least for some months. I was supposed to produce and supply the cars to Sierra Leone all at once but I didn’t have the financial resources and approached NEXIM Bank. Although they approved giving me the money, after six months we didn’t get anything and I was going to lose that opportunity so I had to export the cars in 3 batches. Now I only approach CBN when I need to buy equipment. CBN would then give me fx at three different times. So far I can say Bank of Industries have been helpful. The question I want you to ask banks during your report is “The export financing banks, How many exports do they really sponsor?” These were the words of Dr. Innocent Chukwuma, CEO of Nigerians First Indigenous Car Manufacturing Company Innoson Vehicles Manufacturing.

A former bank CEO who declined to be mentioned said the illegality occurring with the CBN’s insistence on an official rate is an open secret. “There is a challenge when we dollarize the Nigerian economy. Naira is our legal tender not dollars. There is really no need to have domiciliary accounts as we have in Nigeria. Ideally, anybody that sends dollars to Nigeria should be bought over by CBN and the bank should credit your account with the naira. With the emergence of MasterCard, visa card and the likes, the business of BDCs should have stopped. I would suggest that the CBN allows the Naira to become freely convertible which would lead to the official devaluation of the currency in the near term. What is happening is worse than devaluation because there is a rising uncontrollable black market”.

Furthermore, the International Monetary Fund had reiterated its past recommendations to move towards a unified and market-clearing exchange rate by dismantling the various exchange rate windows at the CBN accompanied by clarity on exchange rate policy and supportive fiscal and monetary policies. “In the medium term, the CBN should step back from its role as main FX intermediator, limiting interventions to smoothing market volatility and allowing banks to freely determine FX buy-sell rates”.

Taiwo Oyedele, Fiscal Policy Partner and Africa Tax Leader at PwC stressed on the fx issues saddling the demand side of the market. “We do not have enough fx to meet our demand. On the demand side, you push legitimate transactions out of the official market. Then the ones you say are eligible for fx are on the queue for fx for 6 months , so when they manage to get 5-10% of what they request for, this comes with a lot of hanky panky in the process such that even though CBN record says N445/$1 as the official rate, in reality, they are having to pay a premium to make the arrangement. The whole system has in a way muddled up to create a safe space for bad behavior. Where are BDC’s getting FX? It’s either some people are round tripping from official sources or some people have their dollars and will rather sell to BDC’s than give the government because the margin is just crazy. We need to make the official market the only market. I would advise that there is transparency, there should be a handshake between the fiscal and monetary policy and finally harmonize and bring all legitimate fx demand to the official market and use CBN intervention of buying and selling to moderate the market rate.

During an interview earlier in the year with Nosa Igbinadolor of Businessday, President of the Association of Bureau De Change Operators of Nigeria Aminu Gwandabe reiterated his stance on the existing multiple exchange rate. “You cannot have both a floating exchange rate and a hard exchange rate at the same time. It sends wrong signals to investors and allows for round tripping, which allows some people to make so much profit doing nothing. This policy has not worked and the fact that the CBN still continues with it is unfathomable. There is a need for collaboration between the BDCs and the CBN in the implementation of market-friendly policies that would make the BDCs’ impact more positive on the market, and promote exchange rate stability in the economy. The dual exchange regime has been an avenue for profit-making and has not met the objectives of the CBN. It should be scrapped”.